Q3 M&A: Businesses & Valuations Remain Resilient in Face of Strong Headwinds

- Todd

- Nov 14, 2022

- 3 min read

Updated: Nov 15, 2022

Economic uncertainty — from a combination of inflation, persistent supply chain challenges and continued geopolitical tensions — continues to put a damper on public corporations and top tier dealmaking. However, the lower middle market (LLM = companies between 10-250M in revenue) in the US remains a notable bright spot as earnings and revenues have generally held up well, so valuations are holding up too.

In Axial’s previous Pursuits Reports it highlighted how the availability of dry powder has created a stabilizing force for M&A in the lower middle market. $3.2 trillion worth that will fuel ongoing LMM deals over the final quarter of the year and moving into 2023.

2022 M&A is a banner year…If you remove the outlier…2021

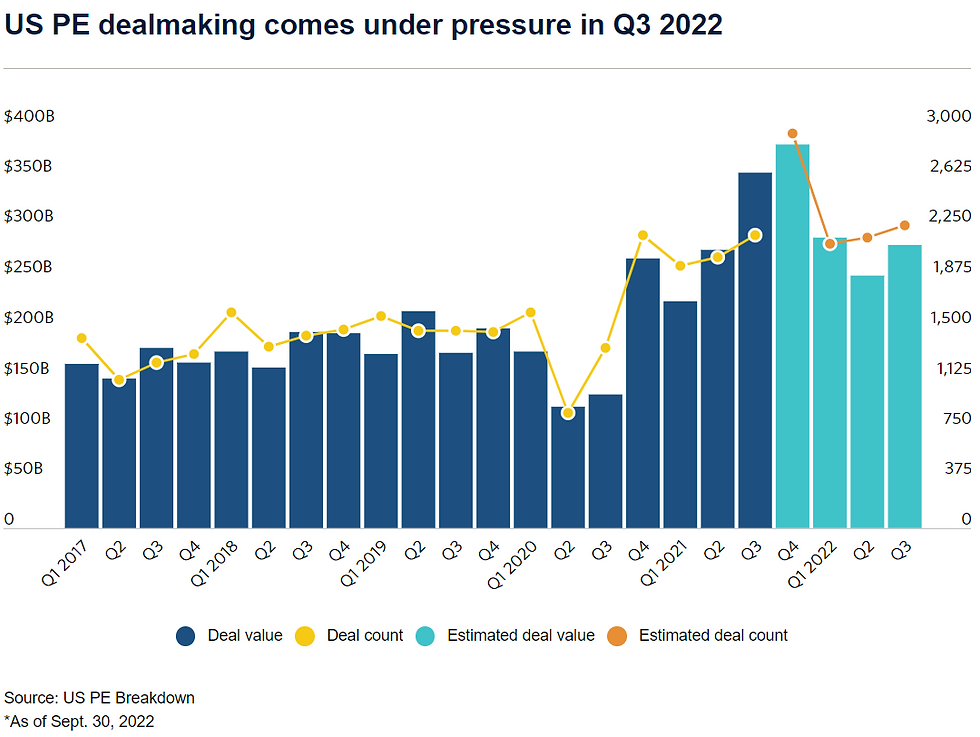

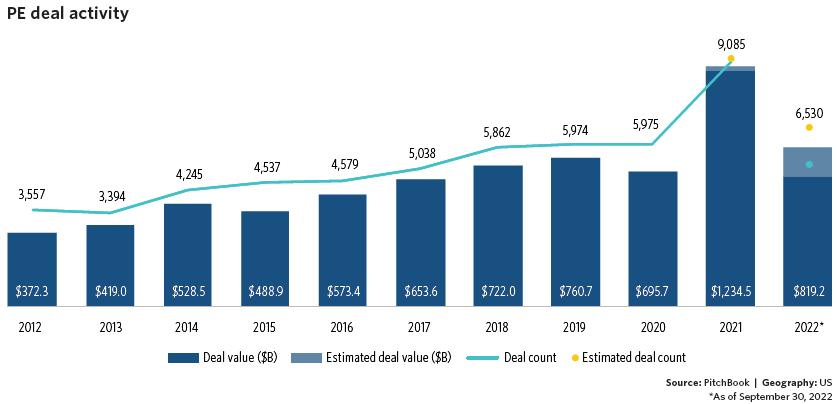

PE-led deal activity finally felt the bite of higher interest rates. The fact that M&A is anywhere near 2021 levels this late into the year is no small feat. Last year, after all, was an aberration. The combined forces of fiscal and monetary stimulus unleashed a torrent of deal activity for some of 2020 and all of 2021, with certain areas of capital markets doubling — and sometimes tripling — from pre-COVID-19 levels. A fairer comparison would be to benchmark today’s activity to the three-year period heading into the COVID “bump.” On that basis, Q3 activity is up when compared with the “old” normal of 2017 to 2019, which at the time was considered a blistering pace for US PE dealmaking.

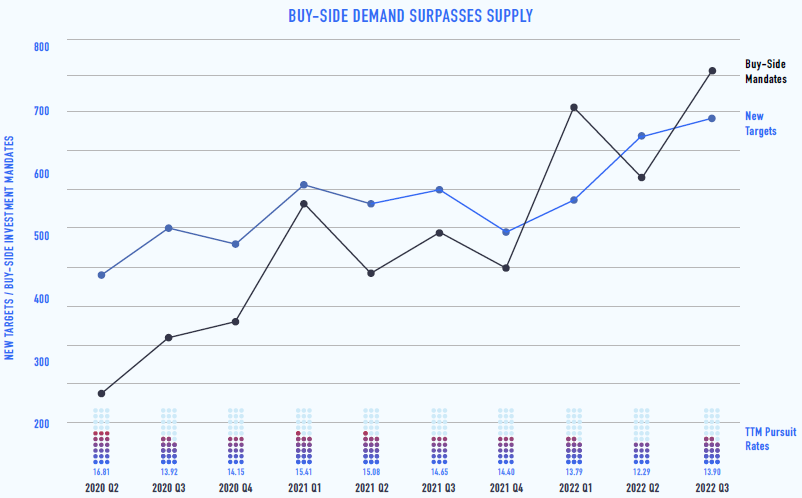

Continued Rise in Supply and Demand Across the LLM:

On the buy-side, new mandates from prospective acquirers exploded by 24% quarter over quarter. But the year over year level of buy-side activity is truly staggering. The total number of new mandates surpassed the same period last year by a whopping 42% — comfortably the strongest performance for any quarter since the start of 2020. In September alone, buy-side activity jumped to 167 fresh mandates, an increase of 8.7% in just one month.

Source: Axial Fall 2022 Report

On the sell-side, deal flow remained robust in the third quarter. The number of targets brought to market experienced a marginal shift quarter over quarter. However, despite remaining relatively flat, Q3 remains impressive because Q2 topped its priors, eclipsing the former record level established in the opening quarter of 2021. Year over year, the level of sell-side activity in Q3 achieved a 19.6% increase over the same period last year.

The misalignment between buyers and sellers has kept pressure on valuations to remain elevated and for some, has created an additional valuation premium for companies within the flight to quality phenomenon.

While the data above sounds like positive news, interest rates potentially pose the greatest risk to valuations. Buyers today need to put 50% down in equity compared to Feb of this year to breakeven due to today’s leverage rates. Floating rates for loans on leveraged buyouts averaged 4.8% in February before doubling to 9.8% in September. For the old 70/30 LBO template of 70% debt, 30% equity, that means taking the equity component to 50% or more to keep interest costs in check, and Pitchbook’s data shows early evidence of that playing out due to large amounts of dry powder sitting on the sidelines and the need to deploy that capital. The other remedy for buyers, of course, is to find assets at a 50% haircut to what they were once valued at. Sellers are resisting that for now, and deal activity has declined as a result compared to 2021.

Reading the tea leaves:

Despite pessimism about the global economy at large, LLM business leaders are finding better odds at home with favorable market dynamics. The strong dollar has helped companies import products more cheaply, and because few of their sales are global, a strong dollar doesn’t have an adverse effect. And although businesses are still fighting supply chain issues, there are very strong order backlogs. These dynamics have allowed businesses to raise prices and, in many cases, expand margin. A J.P. Morgan study found that 70% of middle market business leaders are optimistic about their own company's performance, and 73% are looking for revenue increases in the next year.

To learn more about Vercor, the "flight to quality phenomenon" or how your company can benefit and best position itself within the M&A landscape, call or email me now to receive 3 hours of free consultative analysis. Our analysis offers clarity, based on your objectives, if a full or partial exit, recapitalization, divestiture, acquisition or pre-sale exit strategy provides the greatest benefit to you and your company.

Vercor has been delivering M&A expertise for over 25 years. We serve as a trusted partner to help build long term, iterative strategies that ensure you are positioned to meet your unique personal and financial goals whether it is selling, recapitalizing, acquiring or divesting of a division. Now is the time to evaluate, strengthen, prepare and increase the market value of your company regardless of your timeframe.

Todd Cummiskey

Vercor

704-926-6564

Comments